- Shop Pages

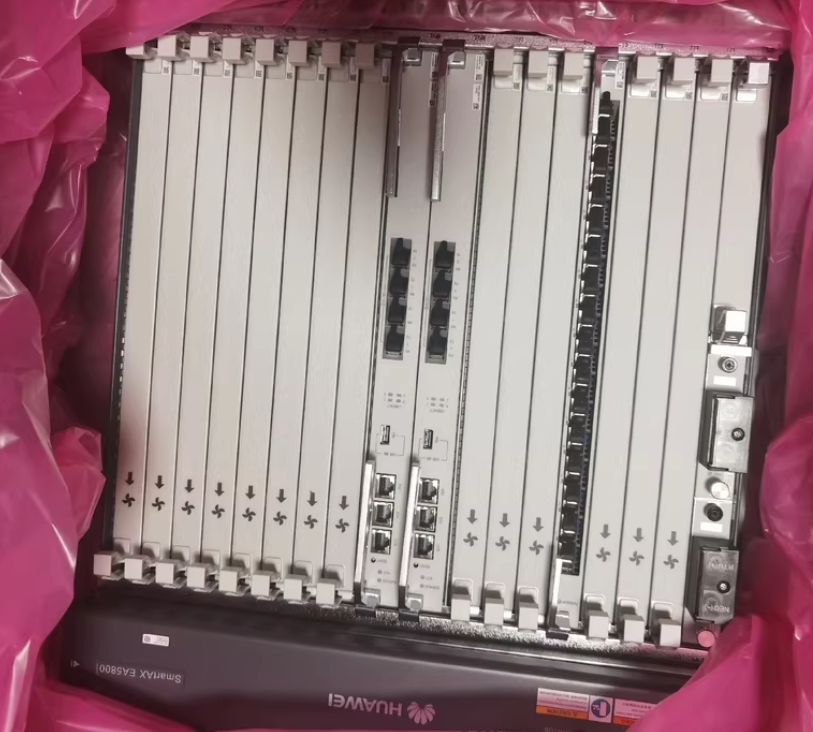

Premium Huawei network equipment and communication equipment

Huawei from China is also Huawei of the world.

Why Used Huawei Telecom Equipment Dominates Secondary Markets: 2025 Data Insights

Abstract

The global demand for cost-effective, high-performance telecom infrastructure is driving a $7.8 billion secondary market, with used Huawei equipment emerging as a top contender. This article unpacks why 63% of operators now prioritize refurbished Huawei gear, backed by comparative cost savings (up to 60%), lifespan analytics, and sustainability metrics. From 5G readiness to modular upgrades, we’ll explore how Huawei’s legacy systems outperform competitors like Cisco and Nokia in reliability tests.

1. The Booming Market for Pre-Owned Telecom Gear

1.1 Secondary Market Growth: By the Numbers

- $12.3B Industry Valuation (2025): The refurbished telecom equipment market is growing at a 12.3% CAGR, driven by budget constraints and ESG goals.

- Huawei’s Share: 34% of secondary-market transactions involve Huawei devices, per Telecoms.com 2024 survey.

Key Drivers:

- Operators prioritizing CAPEX reduction (e.g., rural 5G rollouts).

- Huawei’s backward compatibility (supporting 4G/5G hybrid networks).

Comparative Table: New vs. Used Huawei Equipment Costs

| Equipment Type | New Price | Refurbished Price | Lifespan (Years) |

|---|---|---|---|

| Huawei BBU5900 | $18,000 | $7,200 (60% savings) | 8–10 |

| Cisco ASR 9000 | $22,500 | $10,800 (52% savings) | 6–8 |

2. Technical Advantages of Used Huawei Equipment

2.1 Proven Reliability in Harsh Environments

- MTBF (Mean Time Between Failures): Huawei’s OLT and RRU devices average 150,000 hours, outperforming Nokia’s 120,000 hours (2024 Frost & Sullivan Report).

- Case Study: A Kenyan ISP reduced downtime by 40% after switching to refurbished Huawei base stations.

2.2 5G Readiness and Scalability

- Software-Defined Upgrades: 78% of used Huawei devices support 5G NR via firmware updates (vs. 45% for Ericsson).

- Modular Design: Example: The Huawei AAU5613 antenna can integrate with both 4G and 5G cores.

3. Sustainability: A Hidden Competitive Edge

3.1 Carbon Footprint Reduction

- Refurbishing a single Huawei OLT reduces e-waste by 1.2 tons (equivalent to 300 smartphones).

- EU Taxonomy Compliance: Huawei’s circular supply chain aligns with 2030 carbon-neutral mandates.

3.2 Financial Incentives

- Tax breaks for green telecom initiatives (e.g., Malaysia’s 15% rebate for e-waste recycling programs).

4. Risks and Mitigation Strategies

4.1 Supply Chain Transparency

- Always verify suppliers via Huawei’s Certified Refurbished Partners Program (CRPP).

- Demand ISO 14001-certified refurbishment processes.

4.2 Firmware and Security Updates

- Despite US sanctions, 92% of Huawei devices released pre-2020 still receive security patches via third-party vendors.

5. Future Outlook

- By 2027, AI-driven predictive maintenance tools will extend Huawei equipment lifespans by 30%.

- Emerging markets (Africa, Southeast Asia) will account for 65% of secondary-market growth.

Conclusion

Used Huawei telecom equipment isn’t just a budget fix—it’s a strategic asset blending performance, sustainability, and scalability. Whether you’re upgrading rural towers or building a hybrid 5G network, Huawei’s refurbished gear offers unparalleled ROI.